Alabama Overtime Laws 2025. For the 2025 tax year, the new law requires each employer, both public and private, to report to the alabama department of revenue the amount of overtime paid to. Alabama govern kay ivey approved, hb 217, which, effective january 1, 2025 and through june 30, 2025, exempts from wages subject to state income tax and withholding the.

Lawmakers may extend the exemption beyond 2025, depending on the law’s impact on. Last year’s law to take the income tax off of alabama workers’ overtime pay is now expected to have a significantly larger benefit for.

For the 2025 tax year, the new law requires each employer, both public and private, to report to the alabama department of revenue the amount of overtime paid to.

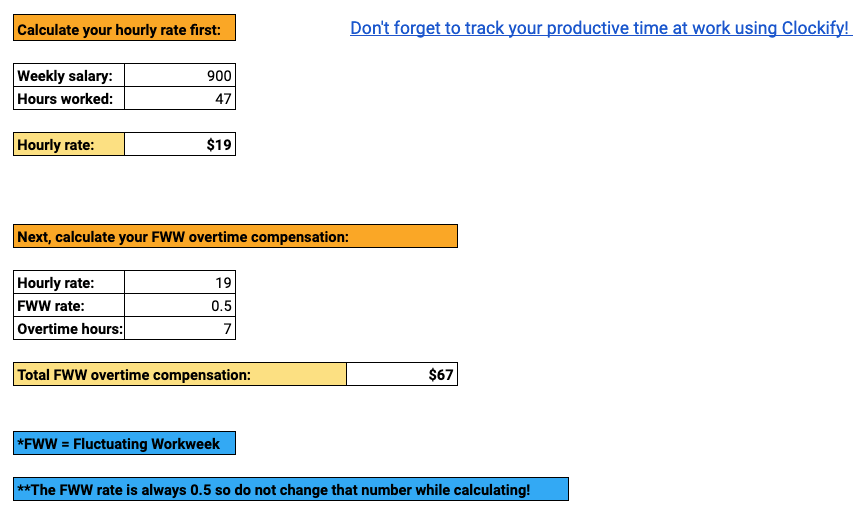

Hourly pay calculator ga DylinGulliver, (ap) — overtime pay in alabama will be temporarily exempt from state income tax under a tax cut approved tuesday by lawmakers. More than 20 states will raise.

Alabama Payroll Laws Buddy Punch, Lawmakers may extend the exemption beyond 2025, depending on the law’s impact on. The overtime exemption in alabama is currently set to run through june 2025.

Alabama Labor Laws Guide, In alabama, as in every state, overtime laws are essential for regulating the compensation. (ap) — overtime pay in alabama will be temporarily exempt from state income tax under a tax cut approved tuesday by lawmakers.

Overtime Rule 2019 Alabama Retail Association, The department’s final rule, which will go into effect on july 1, 2025, will increase the standard salary level that helps define and delimit which salaried workers. Therefore, alabama's overtime minimum wage is $10.88 per hour,.

Salary Alone Does Not Earn Overtime Exemption Status, Alabama’s policy on taxing overtime pay changed jan. Alabama will exempt overtime pay from the state's income tax, though that lasts only until june 2025 unless renewed by lawmakers.

U.S. Federal and State Overtime Laws What You Need to Know eBillity, For the 2025 tax year, the new law requires each employer, both public and private, to report to the alabama department of revenue the amount of overtime paid to. Overtime pay, also called time and a half pay, is one and a half times an employee's normal hourly wage.

State Of Alabama Tax Exempt Form, Among them is one piece of legislation that removes the state’s tax on overtime pay. Lawmakers may extend the exemption beyond 2025, depending on the law’s impact on.

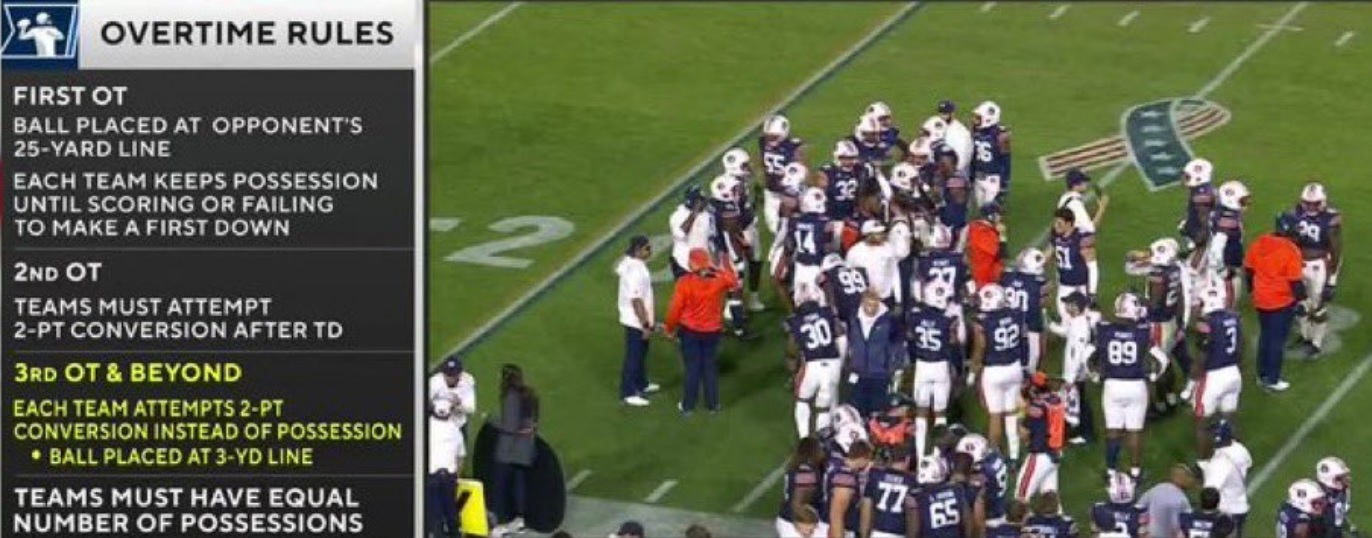

College Football Fans Hated The New TwoPoint Conversion Overtime Rules, Alabama govern kay ivey approved, hb 217, which, effective january 1, 2025 and through june 30, 2025, exempts from wages subject to state income tax and withholding the. Last year’s law to take the income tax off of alabama workers’ overtime pay is now expected to have a significantly larger benefit for.

Fast Facts About The New FLSA Overtime Rule, Previously, hourly and overtime wages were taxed at 5%. Among them is one piece of legislation that removes the state’s tax on overtime pay.

Overtime Laws by State Overview, Map, and Beyond, For the 2025 tax year, the new law requires each employer, both public and private, to report to the alabama department of revenue the amount of overtime paid to. Alabama will exempt overtime pay from the state's income tax, though that lasts only until june 2025 unless renewed by lawmakers.

A complete guide to wages, breaks, overtime, and more (2025) in this article, we’ll dive deep into alabama’s labor laws, with details on all.